Adi Swarup Patnaik

Startup entrepreneurs can definitely prefer & rely on the services of Legal Pillars for Incorporation of LLP/Companies. Good service by Ms. Sneha Kapoor.

Don't Delay, File Today! Due Dates are Approaching Soon.

Customers Served

Project Delivered

Google Rating

10.5k+ Happy Reviews

A Private Ltd. Company must consider following details related to Annual ROC Compliance:

Note: Above charges are excluding gov. fees & other charges.

Note: Above charges are excluding gov. fees & other charges.

Note: Above charges are excluding gov. fees & other charges.

Connect with our Experts and Get personalized Solution.

Book your Call Now

Every Company that is registered under Companies Act, 2013, has to file their annual Annual ROC Compliance such as Income Tax Returns, ROC forms Filing. It's difficult to keep update all the annual compliance requirements for private limited company by yourself. That's why Legal Pillers assist you with annual compliance for pvt ltd company. Maintaining proper ROC compliance is not just a legal requirement, but it also shows your commitment to being accountable to government department and your company.

Every company must consider that compliance for private limited company is mandatory in nature and no company must leave it. Otherwise company and its director has to pay penalties and late fees as prescribed under Companies Act, 2013.

Our experts streamline the ROC Compliance process, ensuring a smooth and hassle-free experience for you.

Our Income Tax Experts will ensure proper Tax management for your Company, so that you can save your hard earned money and can utilize it for betterment of your business.

With Legal Pillers, you have a dedicated team of experts committed to ensuring that all your filings are submitted on time to avoid fines.

We maintain and keep you updated with the compliance date so your work is done within Government Regulations. Our high level technological platforms you will get access to our compliance calender.

Timely filing of private limited company roc compliance allows the company to take advantage of tax benefits to companies. Compliance also helps in avoiding penalties.

Completing ROC annual compliance allows company to reduce their legal risk. If your company is filing all ROC & other Annual Compliances timely, it shall leads to proper governence by company.

Timely submission of annual reports and financial statements ensures that your Company maintains a solid financial footing and it helps maintaining its credibility before stakeholders.

Directors of Private Limited Companies have a legal responsibility to ensure compliance. Dooing compliance for private limited company timely, it helps in reduction of their personal liability.

Proper compliance avoids costly fines and penalties imposed by regulatory authorities. Otherwise under Companies Act, 2013 heavy penalties are there which are prescribed.

A well-compliant Private Limited Company is viewed respectfully in any business community. It also helps in boosting confidence of company before all stakeholders.

As per Companies Act, 2013 and other law applicable, a Private Limited company have to do various compliances.

More DetailsA Private Limited company must conduct its first Board Meeting within 30 days of its registration and during the Financial year atleast 4 Board meetings must be conducted by directors of company.

Every director at the first meeting at which he is engaged as director, or the first meeting of the Board at the beginning of each Financial Year, or if there is a variation of disclosures must be made clear on the form MBP-1 with their stake in any company. The Form MBP-1 should be maintained in the records of Company.

The Board of Directors shall appoint the first Auditor of the Company within 30 days of the date of incorporation. The Auditor will continue in office until the conclusion of Annual General Meeting. For the purpose of appointing the First Auditor, filing of ADT-1 is required.

Every Private Limited Company is expected to submit its Annual Return in Form MGT-7 within 60 days after the holding of the annual general meeting. In case company skipped to file return, a late fees prescribed under the law is applicable.

Each Private Limited Company is expected to file Financial Statements of 'Balance Sheet' with a report of 'Profit and Loss Account' and 'Director?s Report' on form Form AOC-4 in the first 30 days after the date it holds off the 'Annual General Meeting.

A Private Limited Company must have to file their ITR with Income Tax Department within the time limit prescribed by the government. Under this company have to submit all data related to balance sheet and profit loss account.

All directors of companies have to file Directors KYC form which is DIR-3 KYC before 30 September every year.

Customer satisfaction is our major goal. See what our clients are saying about our services.

Startup entrepreneurs can definitely prefer & rely on the services of Legal Pillars for Incorporation of LLP/Companies. Good service by Ms. Sneha Kapoor.

It is really one of the best team, which give lot of respect in dealings and help us at every moment. Thank you legal pillers for helping us at every small steps.

Good work, I am happy with services - Legal Pillers for providing best services for 12A80G in economical prices and in a good speed way. The co-ordination between various team members is also remarkable. Even they all continuously follow up with calls and messages regarding the processes. Also one more good point is all the services are under one umbrella. Special thanks to Shweta, Kalpana, Priya & all the backend team member for execution.

Team Legal Pillers, I am writing to thank you for the quality of service provided by your company. I am sincerely appreciating your efficient, gracious customer service on registering my company. Specially I would like to Thank Ritika who always connected with me and explained in detail while registering company. I would refer my friends to legal Pillers to take best service in low cost.

Very corporative and guides you in a proper way. This was my first time doing online legal services and out of all fear I had it turned out a boon for me. Hope you people keep the services same in future to. For a new startup u can believe them. Thank you once again

We are from Hyderabad, Telangana State. We have taken Services of "Legal Pillers" for New Private Ltd Company Registration. We are extremely satisfied and delighted with their services. They are sincere, experienced and committed. Unquestionable Integrity. Our Interaction was with Ms.Sneha, Mr.Rohit and Ms.Jyostna, excellent team and keeps their word.

Find answers to most popular questions asked to us.

ROC Compliance involves the timely submission of various documents and reports to the Registrar of Companies to maintain transparency and accountability in business operations.

Yes, Income Tax Filing is a crucial component of ROC compliance for private limited companies.

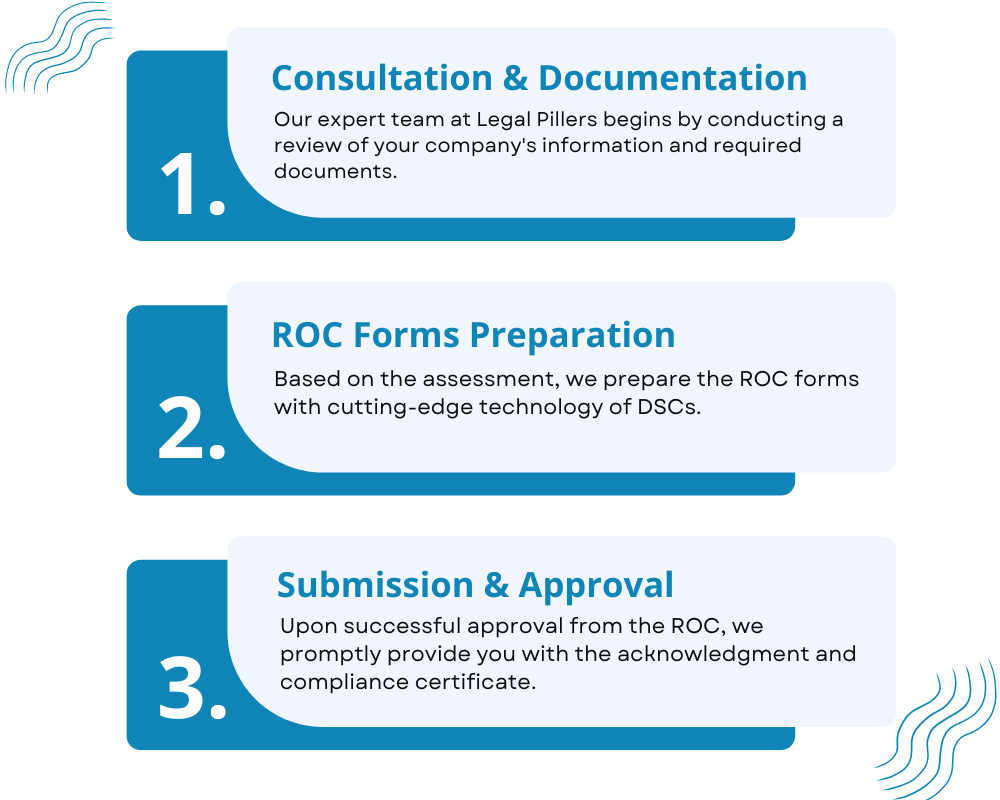

Filing ROC compliances involves a series of steps, including: Preparation and submission of financial statements Annual returns board meeting minutes, AGM documentation.

You can check the ROC filing status of your company through the Ministry of Corporate Affairs website. Legal Pillers can guide you on how to access and interpret this information, ensuring you stay updated on the compliance status of your Pvt Ltd Company.

ROC filing involves a structured process of preparing and submitting forms along with the required documents to the Registrar of Companies. Legal Pillers simplifies this process by providing a step-by-step guide and hands-on support from our team of experts.

The deadline for the year ending on 31 March 2023 is 30 May 2023. For the year ending on 30 September 2023 the due date is 29 November 2023.

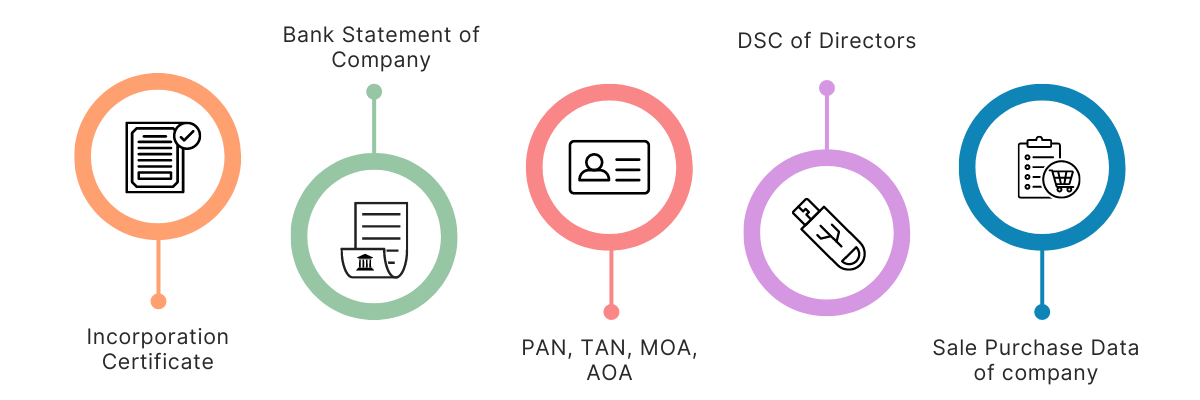

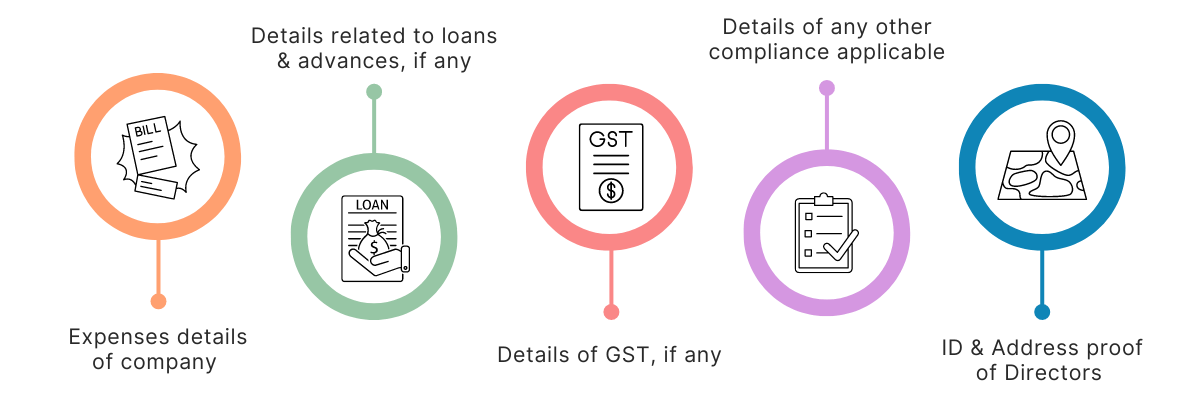

Generally, they include financial statements, board resolutions, shareholding details, and other relevant company records. Legal Pillers provides a detailed checklist of the documents needed for each type of ROC filing.

Yes, a company can choose to handle its own ROC filing. However, this can be a complex and time-consuming process. Many companies prefer to partner with professionals like Legal Pillers to ensure accurate and timely compliance.

ROC compliances for private limited companies encompass a range of activities, including: Preparation and submission of audited financial statements Changes in Directors or Shareholders. Registered Office Change. Company Filings for Approval. Director Identification Number. Annual returns Maintenance of statutory registers Compliance with income tax and GST regulations, etc.

ROC Compliance Fees vary based on factors such as the size and type of the Company. Legal Pillers provides affordable fee structures tailored to the specific needs of each client.

The MCA has notified that the time limits for the AOC-4, AOC-4 (CFS), AOC-4 XBRL, and AOC-4 Non-XBRL forms till 27 September 2023 for OPC and 29 October 2023. For other various forms like MGT 7/MGT 7-A, the time limit is till 28 November 2023, within 60 days of AGM.

Yes, ROC compliance is compulsory for all private limited companies in India. Non-compliance can lead to severe penalties, legal consequences, and even the dissolution of the Company. Companies must fulfill these obligations to maintain their legal standing.

OPC (One Person Company) ROC Compliance involves adhering to the statutory requirements set forth by the Ministry of Corporate Affairs for companies registered as OPCs.