Adi Swarup Patnaik

Startup entrepreneurs can definitely prefer & rely on the services of Legal Pillars for Incorporation of LLP/Companies. Good service by Ms. Sneha Kapoor.

Get PF & ESIC Registration in just 2 Days* with LegalPillers.

Customers Served

Project Delivered

Google Rating

10.5k+ Happy Reviews

To start with EPF Registration, you have to check given criteria first. It is for:

Note: Above charges are excluding gov. fees & other charges.

Note: Above charges are excluding gov. fees & other charges.

Note: Above charges are excluding gov. fees & other charges.

Connect with our Experts and Get personalized Solution.

Book your Call Now

EPF Registration

PF Registration online refers to Employees' Provident Funds where they can contribute some portion of their salary and employers are also required to contribute some amount on behalf of employees. The purview of EPF Registration comes under Employees' Provident Fund Organisation (EPFO) which regulated by Employees' Provident Funds and Miscellaneous Provisions Act, 1952. EPFO is the world's largest Social Security Organisation which works for workers' welfare. In general terms, EPF is normally a benefit that employees got after their retirements.

ESIC Registration

Employees' State Insurance (ESI) Scheme is a social insurance plan established by the Employees' State Insurance Act, 1948. This scheme seeks to safeguard the interests of the employee or worker when conditions or events are not anticipated. The ESIC is an impartial frame created through the regulation under the Ministry of Labour and Employment, Government of India. The ESI scheme provides social security to the workers. Employers and employees contribute a percentage of employee's wages towards ESI every month. With years of expertise.

More DetailsProvides Tax benefits to both Employee and Employers as contributions to EPF and ESI are tax deductible which reduces taxable income. Employers also receive tax benefits for contributing to EPF and ESI.

EPF and ESI social security schemes provide employees with financial security and health benefits. EPF ensures employees have a retirement corpus, while ESI provides for medical benefits.

ESI provides a safety net for employees in medical emergencies. It covers hospitalization, maternity, disability, and related expenses.

Our team is committed to providing ongoing support, ensuring that you remain in compliance with all relevant regulations, all accessible through our convenient online platform.

EPF and ESI registration is mandated by the government for those companies which are falling under prescribed rules in India.

EPF & ESIC is a long-term savings scheme that helps employees accumulate a corpus for their retirement.

Failure to register for EPF and ESI can lead to legal issues, including fines and potential business closure.

Contributions to EPF and ESI are tax deductible. This helps in reducing their taxable income for employees. Employers also receive tax benefits for contributing to EPF and ESI.

Organizations who are enrolled under these registrations usually shows that they care for their employees, which create a good impact on employees.

Compliances of EPF & ESIC registrations are not tough, simple calculation is required to identify the part of contribution.

In India, the Provident Fund (PF) and Employee State Insurance (ESI) registration are mandatory for certain industries where the number of employees crosses a specified threshold. These registrations are aimed at providing social security benefits to employees. Industries that typically require PF and ESI registration include:

PF & ESIC Registration may require for thses kind of industries, however, companies and organizations are exempt upto 20 employees.

In most of cases it seems that the companies putting government tender and there is involvement of various employees of company to fulfil the tender requirement, may require to take PF/ESIC registration.

Factories engaged in manufacturing processes often require PF and ESI registration. Construction companies, contractors, and firms involved in large-scale construction projects need to register for PF and ESI having a certain number of workers.

Manpower providers like hospitality business companies, Retail, IT/ITES and Services, Textile manufacturing units, and garment factories employing a specific number of individuals are required to register for PF and ESI.

Companies engaged in transportation, logistics, and related services may require these registrations as well.

Customer satisfaction is our major goal. See what our clients are saying about our services.

Startup entrepreneurs can definitely prefer & rely on the services of Legal Pillars for Incorporation of LLP/Companies. Good service by Ms. Sneha Kapoor.

It is really one of the best team, which give lot of respect in dealings and help us at every moment. Thank you legal pillers for helping us at every small steps.

Good work, I am happy with services - Legal Pillers for providing best services for 12A80G in economical prices and in a good speed way. The co-ordination between various team members is also remarkable. Even they all continuously follow up with calls and messages regarding the processes. Also one more good point is all the services are under one umbrella. Special thanks to Shweta, Kalpana, Priya & all the backend team member for execution.

Team Legal Pillers, I am writing to thank you for the quality of service provided by your company. I am sincerely appreciating your efficient, gracious customer service on registering my company. Specially I would like to Thank Ritika who always connected with me and explained in detail while registering company. I would refer my friends to legal Pillers to take best service in low cost.

Very corporative and guides you in a proper way. This was my first time doing online legal services and out of all fear I had it turned out a boon for me. Hope you people keep the services same in future to. For a new startup u can believe them. Thank you once again

We are from Hyderabad, Telangana State. We have taken Services of "Legal Pillers" for New Private Ltd Company Registration. We are extremely satisfied and delighted with their services. They are sincere, experienced and committed. Unquestionable Integrity. Our Interaction was with Ms.Sneha, Mr.Rohit and Ms.Jyostna, excellent team and keeps their word.

Find answers to most popular questions asked to us.

PF registration is the process by which an employer registers with the Employees' Provident Fund Organization (EPFO) to provide benefits like provident fund, pension, and insurance to their employees.

Any organization or entity employing 20 or more employees is required to register for PF. However, voluntary registration is also possible for entities with less than 20 employees.

No, PF registration is the responsibility of the Employer. Employees automatically become members once the Employer registers with the EPFO.

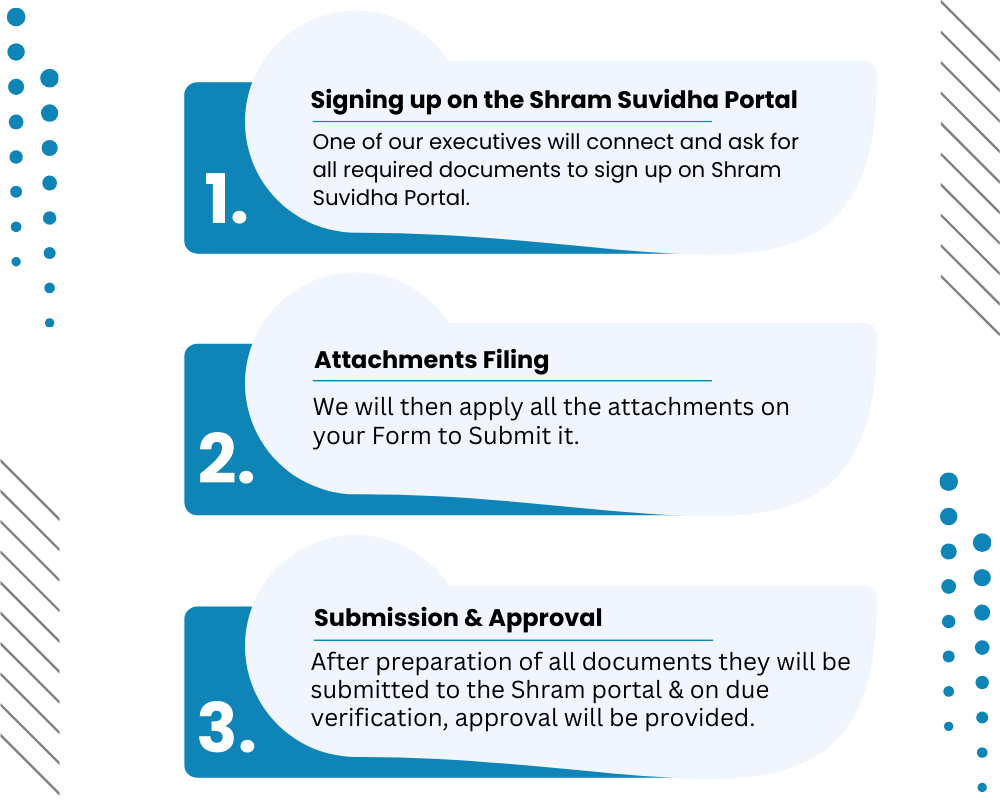

Employers can register for PF online through the EPFO's Unified Portal. They must provide details about the organization, employees, and supporting documents.

The registration process typically takes 15-20 working days, but this can vary based on the workload of the relevant government authorities.

The process generally involves creating a login on the Unified Portal, filling out the required information, submitting supporting documents, and generating an acknowledgment.

The ESI scheme is a complete social security program that was created to fulfill the purpose of socially safeguarding employees of the organized sector against disability, sickness, maternity, or death as a result of injuries to the workplace.

Who needs to be eligible for ESIC registration?

The ESIC scheme doesn't cover those who work or who have a salary of greater than Rs.21,000 per month. In the case of someone who has disabilities, the maximum salary is the equivalent of Rs. 25,000.

The insured employee and their family members can avail medical benefits as of the first day of beginning the insurance coverage.

Yes, it is the legal responsibility of the Employer under Section 2A in the Act in conjunction with regulation 10-B to declare their Factory Establishment or establishment by the ESI Act within 15 days from the date that they apply to them.

The ESI Act of 1948 provides that an establishment with over ten workers working in the business pays a maximum salary of Rs.21,000 per month. Employees must apply for ESI approval per the ESI Act within 15 days.

In the case of 6.5 percent of ESI contribution, only 1.75 percent is deducted from the employee's pay while the rest is paid to the company.

The government introduced various health benefits for low-income families. The families covered by the NHPS scheme can avail of medical facilities for medical treatments and their children.