Adi Swarup Patnaik

Startup entrepreneurs can definitely prefer & rely on the services of Legal Pillars for Incorporation of LLP/Companies. Good service by Ms. Sneha Kapoor.

Make your Business TDS complaint with Industry Experts.

Customers Served

Project Delivered

Google Rating

10.5k+ Happy Reviews

There are various types of categories in which TDS can be filed. They include:

Do you know, Individuals whose tax on income at-source for a particular income is deducted and reported to the government must file their tax deduction returns. A tax return has to be filed within a certain timeframe and must include the necessary information concerning taxes deducted and tax deductor. TDS return filing is performed by employers or organizations that have obtained the tax deduction and collection number (TAN). Streamline Your Finances with Expert TDS Return Filing Services. Legal Piller's efficient CA/CS Portal gets you TDS Registration and Filing Solutions tailored to your needs.

Managing TDS (Tax Deducted at Source) can be a daunting task, but with Legal Pillers, you're in expert hands. Our specialized TDS services are designed to ensure compliance, accuracy, and timely filing.

Ensure compliance from the outset. Our experts will guide you through the process, ensuring seamless registration for TDS.

From preparation to submission, we handle it all. Trust Legal Pillers for accurate and timely TDS return filing.

Our expert advisors will provide you with a detailed consultation and the specific requirements tailored to your business.

Convenience at your fingertips. Our online platform ensures a hassle-free experience for filing your TDS returns.

It encourages individuals and businesses to comply with tax regulations, promoting a culture of tax honesty.

TDS distributes the responsibility of tax payments across various parties involved in financial transactions.

It encourages taxpayers to plan their finances in a disciplined manner, as they need to allocate funds for TDS.

TDS mandates accurate reporting of income, as it requires proper documentation and record-keeping.

For eligible taxpayers, TDS often results in excess tax deductions, leading to tax refunds.

By ensuring tax compliance, TDS helps individuals and businesses avoid penalties and legal consequences.

TDS forms are mandatory to be submitted under Income Tax Act of 1961. They are dependent upon the earnings of the Tax deducted or on the type of taxpayer who pays taxes. TDS forms are based on the income of deductees or taxpayers as listed:

More DetailsThe statement for the quarterly period of TDS comes from 'Salaries.' It is a detail of salaries paid and TDS deducted from the employees by employer.

These are Quarterly statements of TDS for all other payments, excluding 'Salaries.' This form is to be submitted for tax deduction at source, TDS for all the payments received other than the salary.

It is a Statement of the quarterly period for TDS from dividends, interest, or any other amount that is paid to Foreigners or non-residents. It has to be filled for the declaration of TDS for NRIs and Foreigners

It is a Quarterly report of the collection of non-salary payments made to the residents when seller collects tax from the buyer and pays it to the government. This Form requires mandatory furnish of TAN.

Customer satisfaction is our major goal. See what our clients are saying about our services.

Startup entrepreneurs can definitely prefer & rely on the services of Legal Pillars for Incorporation of LLP/Companies. Good service by Ms. Sneha Kapoor.

It is really one of the best team, which give lot of respect in dealings and help us at every moment. Thank you legal pillers for helping us at every small steps.

Good work, I am happy with services - Legal Pillers for providing best services for 12A80G in economical prices and in a good speed way. The co-ordination between various team members is also remarkable. Even they all continuously follow up with calls and messages regarding the processes. Also one more good point is all the services are under one umbrella. Special thanks to Shweta, Kalpana, Priya & all the backend team member for execution.

Team Legal Pillers, I am writing to thank you for the quality of service provided by your company. I am sincerely appreciating your efficient, gracious customer service on registering my company. Specially I would like to Thank Ritika who always connected with me and explained in detail while registering company. I would refer my friends to legal Pillers to take best service in low cost.

Very corporative and guides you in a proper way. This was my first time doing online legal services and out of all fear I had it turned out a boon for me. Hope you people keep the services same in future to. For a new startup u can believe them. Thank you once again

We are from Hyderabad, Telangana State. We have taken Services of "Legal Pillers" for New Private Ltd Company Registration. We are extremely satisfied and delighted with their services. They are sincere, experienced and committed. Unquestionable Integrity. Our Interaction was with Ms.Sneha, Mr.Rohit and Ms.Jyostna, excellent team and keeps their word.

Find answers to most popular questions asked to us.

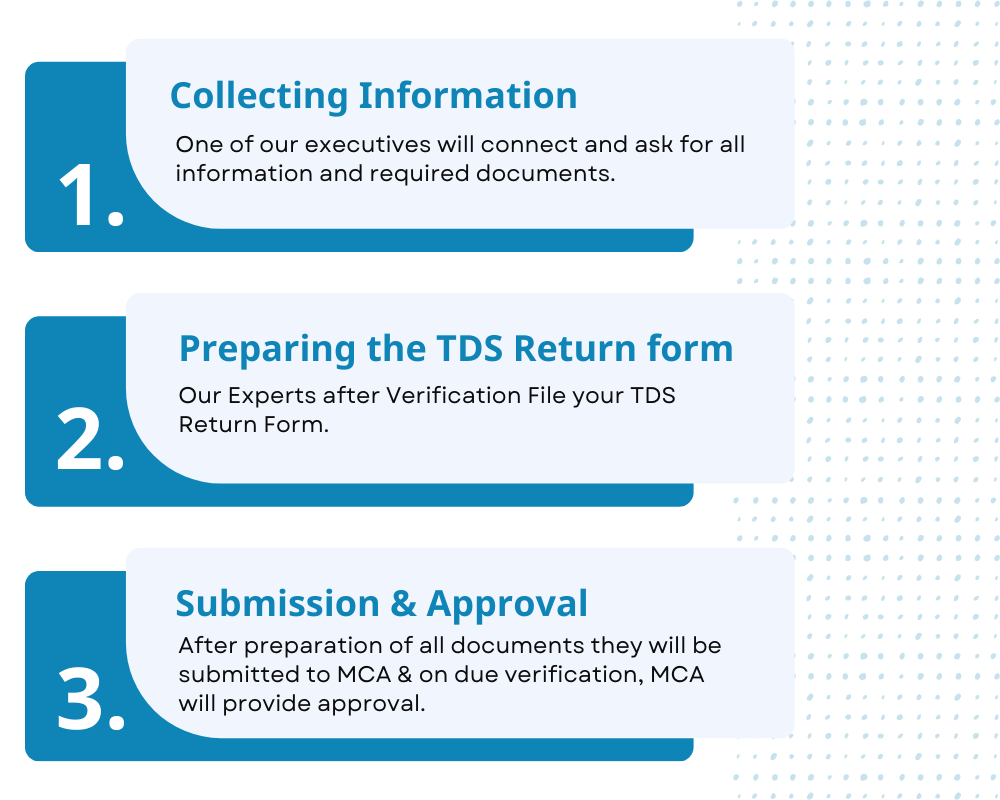

Applying for TDS (Tax Deducted at Source) registration involves a structured process with the Income Tax Department. At Legal Pillers, our experts will assist you in preparing and submitting the necessary documentation, ensuring compliance with all regulatory requirements.

TAN, or Tax Deduction and Collection Account Number, is a unique 10-digit alphanumeric code issued by the Income Tax Department.

Filing TDS online involves the submission of TDS returns on the Income Tax Department's e-filing portal.

TDS quarterly returns can be filed online through the Income Tax.

A TDS return is a statement filed with the Income Tax Department that provides details of tax deducted at source by an entity.

TDS works on the principle of deducting a certain percentage of tax at the time of making payments, such as salaries, commissions, rent, etc.

The deductor, or the entity responsible for deducting TDS, is required to issue a TDS certificate to the deductee.

Online TDS return filing registration is the process of enrolling for electronic filing of Tax Deducted at Source (TDS) returns through a secure online portal. It allows businesses and individuals to submit their TDS information digitally, ensuring efficiency and accuracy in compliance.

The registration process with Legal Pillers online is easy. To register, you can simply connect with our professionals through our portal or contact us. Our experts will guide you through this process to ensure a seamless registration.

LLPs must file annual returns and account statements with the Registrar of Companies (RoC) within the limited given time.

The registration process for online TDS/TCS return filing involves the following steps: Log in to the TDS e-filing portal with your credentials. Go to the 'Profile' section and select 'Register as Tax Deductor/Collector.' Fill in the necessary details including TAN, category of deductor/collector, and contact information. Validate the registration using an OTP sent to your registered mobile number. Complete the registration process by providing additional information as required.

Yes, you can upload multiple TDS returns in one go on the e-filing portal. However, ensure that the returns are in the prescribed file format (e.g., .fvu) and meet the specified guidelines for bulk upload.

To register for TDS return filing, you'll typically need the following documents: PAN card of the deductor/collector. TAN (Tax Deduction and Collection Account Number) of deductor/collector. Address proof of the deductor/collector. Contact details, with email address and phone number. Bank account details of the deductor/collector. Authorization documents (in case of partnerships or companies).

TDS returns must be filed quarterly. The due dates are typically on the 15th of the month following the end of each quarter (i.e., June 15, September 15, December 15, and March 15).