Adi Swarup Patnaik

Startup entrepreneurs can definitely prefer & rely on the services of Legal Pillars for Incorporation of LLP/Companies. Good service by Ms. Sneha Kapoor.

Your annual compliance requirements for LLPs are now easy to maintain with Legal Pillers

Customers Served

Project Delivered

Google Rating

10.5k+ Happy Reviews

Following points are important to keep in mind before ROC Compliance of LLP:

Note: Above charges are excluding gov. fees & other charges.

Note: Above charges are excluding gov. fees & other charges.

Note: Above charges are excluding gov. fees & other charges.

Connect with our Experts and Get personalized Solution.

Book your Call Now

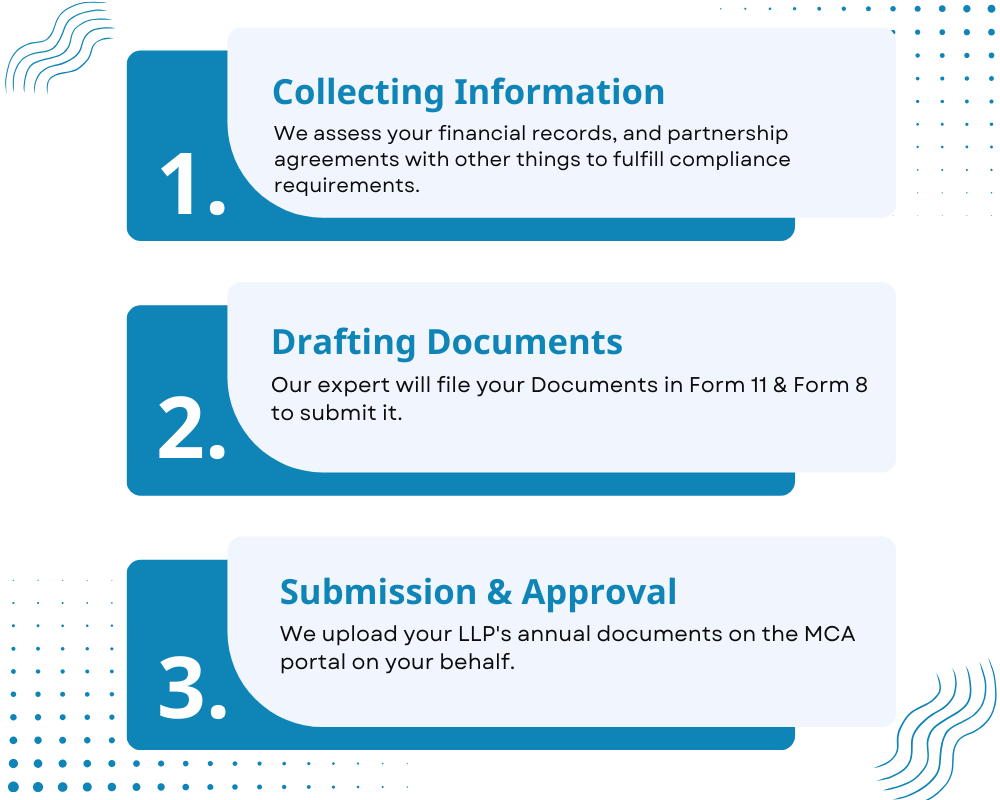

Every type of business structure that is registered in India, like limited liability partnerships, LLPs, or limited liability partnerships, must submit certain documents to the Registrar of Corporations annually. In accordance with the law of 2008 on the Limited Liability Partnership Act and the 2013 Companies Act, all Indian firms and LLPs are required to file ROC annual reports, the annual ROC file. Filing them on certain dates is required. A Limited Liability Partnership (LLP) is a unique form of business organization that has the benefits of both a partnership and a corporation.

More DetailsPartners in an LLP enjoy limited liability, in which their assets are protected from business liabilities. This is a crucial advantage, especially in case of unforeseen financial challenges.

However, a big concern for all entrepreneurs is the maintenance cost for registration they are holding. So you will be delighted to know that cost of maintaining an LLP is much lower as compared to others.

At LegalPillers you will get all kind of assistance related to your business. We will assist you and provide you end to end services.

Our team is committed to providing ongoing support, ensuring that you remain in compliance with all relevant regulations, all accessible through our convenient online platform.

Partners in an LLP enjoy limited liability, their assets are protected from business liabilities. This is a crucial advantage, especially in case of unforeseen financial challenges.

LLPs have simplified compliance requirements compared to other forms of business entities, making them an attractive choice for small to medium-sized businesses.

Fulfilling your compliance obligations portrays your LLP as a responsible and reliable business entity, building trust with stakeholders, including clients, investors, and lenders.

If your LLP is maintaining all compliances, it creates and better goodwill impact in the eye of law and other stakeholders which are related thereto.

Compared to other registrations, LLPs often have fewer regulatory compliance requirements, making them easier and less expensive to manage.

The timely filing of compliance documents helps you avoid costly penalties and legal repercussions, which can have an impact on your bottom line.

In accordance with the LLP Act of 2008, after LLP registration online compared to other registration. However these are mandatory in nature and can not skip by LLP. In case you skipped compliances, there shall late fees prescribed by government. Here is list of compliances which you can go through.

More DetailsEvery LLP holder must file LLP Form 8 in which details of books of accounts & statements of solvency should keep. Form 8 must be certified by the signatures of designated partners. It should be signed by a qualified chartered accountant or practicing company secretary.

LLP must have to file form 11 in which Annual Returns need to file with MCA. This form is a summary of the management activities of LLP. Additionally, form 11 is required to be filed by the 30th of May each year.

LLPs should file their income tax return in Form ITR 5. LLPs that have entered into international transactions with related companies or completed specified Domestic Transactions, must complete Form 3CEB. This form must be certified by a qualified Chartered Accountant.

The Designated Directors need to approve their DIN Allotment through the eForm DIR 3 KYC before September 30th every year. In case any Designated Partner skipped shall be liable to pay a penalty of Rs. 5000/- per director.

Customer satisfaction is our major goal. See what our clients are saying about our services.

Startup entrepreneurs can definitely prefer & rely on the services of Legal Pillars for Incorporation of LLP/Companies. Good service by Ms. Sneha Kapoor.

It is really one of the best team, which give lot of respect in dealings and help us at every moment. Thank you legal pillers for helping us at every small steps.

Good work, I am happy with services - Legal Pillers for providing best services for 12A80G in economical prices and in a good speed way. The co-ordination between various team members is also remarkable. Even they all continuously follow up with calls and messages regarding the processes. Also one more good point is all the services are under one umbrella. Special thanks to Shweta, Kalpana, Priya & all the backend team member for execution.

Team Legal Pillers, I am writing to thank you for the quality of service provided by your company. I am sincerely appreciating your efficient, gracious customer service on registering my company. Specially I would like to Thank Ritika who always connected with me and explained in detail while registering company. I would refer my friends to legal Pillers to take best service in low cost.

Very corporative and guides you in a proper way. This was my first time doing online legal services and out of all fear I had it turned out a boon for me. Hope you people keep the services same in future to. For a new startup u can believe them. Thank you once again

We are from Hyderabad, Telangana State. We have taken Services of "Legal Pillers" for New Private Ltd Company Registration. We are extremely satisfied and delighted with their services. They are sincere, experienced and committed. Unquestionable Integrity. Our Interaction was with Ms.Sneha, Mr.Rohit and Ms.Jyostna, excellent team and keeps their word.

Find answers to most popular questions asked to us.

An LLP, or Limited Liability Partnership, is a unique business structure that offers limited liability protection to its partners. Compliance is crucial to maintaining legal standing, avoiding penalties, and ensuring the continuity of your business operations.

Any LLP, whose turnover is above than forty lakh rupees, or whose contribution is more than twenty-five lakh rupees, is required to get its accounts audited.

The key compliance requirements for LLPs include filing Form 11 (Annual Return), maintaining accurate financial statements, conducting an Annual General Meeting (AGM), and filing the Statement of Account & Solvency (SAS) with the ROC.

The legal compliance after LLP incorporation is Form 8, Filing of Statement of Account (statement of accounts and solvency).

The legal compliance after llp incorporation is Form 8, Filing of Statement of Account (statement of accounts and solvency).

Timely ROC compliance filing ensures legal compliance, enhances credibility, provides financial transparency, helps avoid penalties, and safeguards business continuity.

Legal Pillers stands out due to its expertise, accuracy, timely execution, and comprehensive support. We guide you through every step of the compliance process, ensuring a seamless and legally sound operation for your LLP.

All LLPs have to close their fiscal year before March 31 and submit respective reports to the IT Department. LLPs are required to be audited on their books and file their annual returns before the deadline for filing on September 30 of each year when their annual income exceeds the amount of Rs. 60 lakh.

LLP Compliances must need 2 designated partners to sign.

Yes, CA and CS are mandatory for ROC Compliance. At Legal Pillers, we have a team of experienced Chartered Accountants who specialize in LLP compliance. We follow a meticulous process to ensure that all filings are completed with utmost accuracy.

Yes, an LLP can be closed or dissolved voluntarily by following the procedures outlined in the Limited Liability Partnership Act of 2008.

While GST is not a mandatory requirement for LLP registration, the partners may have to register for GST depending on the amount of turnover and other factors once the LLP is registered.

Legal Pillers is a trusted name in the industry, known for its expertise in handling compliance requirements for LLPs. Our client-centric approach and commitment to excellence set us apart.

Getting started with Legal Pillers is easy. Simply contact us today to discuss your LLP compliance needs, and let us pave the way for your sustained success.Partner with Legal Pillers today, and take rest knowing that your business is in capable hands.