Adi Swarup Patnaik

Startup entrepreneurs can definitely prefer & rely on the services of Legal Pillars for Incorporation of LLP/Companies. Good service by Ms. Sneha Kapoor.

Be Your Own Boss in Just 7 Days* | Simplest and Fastest Way of Registration.

Customers Served

Project Delivered

Google Rating

10.5k+ Happy Reviews

Before going for formation of Pvt. Ltd., you must have proper idea about its features, which are here as -

Note: Above charges are excluding gov. fees & other charges.

Note: Above charges are excluding gov. fees & other charges.

Note: Above charges are excluding gov. fees & other charges.

Connect with our Experts and Get personalized Solution.

Book your Call Now

If you are willing to commence a company in India, then Private limited company registration is the most suitable registration type for budding entrepreneurs. Private Limited Company Registration in India is a quick and easy online company registration process with fewer formalities. Every start-up or developing business favors online company registration as it offers multiple benefits of company registration like legal certification, easy fundraising, restrictions on the liability of its shareholders and much more. The Company Act 2013 governs private limited company registration and Companies Incorporation Rules 2014.

More DetailsIts Registration is done by Ministry of Corporate Affairs that makes it better registration options amongst other registrations.

Pvt Ltd has best option that it can easily avail government schemes, bank loans and other kind of funds in market.

For Register a Pvt Ltd Company in India you don't need to physically presence at any offices. It's 100% Online Porcess.

It provides you protection of your company name with Ministry of Corporate Affairs. No other person can opt for sim ilar name which is already registered.

Liability of shareholders is limited to the amount they have invested in the company. Personal assets are protected, and creditors cannot typically pursue the personal assets of shareholders to cover business debts.

Pvt Ltd. company registration is considered as a separate legal entity different from its shareholders. This separation provides legal protection and makes securing funding or engaging in contracts easier.

Pvt Ltd Companies often have higher credibility and trust in the business world compared to unregistered entities like sole proprietorships or partnerships. This can be advantageous when dealing with customers, suppliers, or investors.

As compare to Partnership Firm, Limited Liability Firm, Sole Propeirtoship firm, Private Limited enjoys lower tax rates. And government has introduces verious subsidies and exemptions also.

The ownership of a private limited company can be easily transferred by selling or transferring shares. This facilitates ownership transitions without disrupting the company's operations.

Registering as a private limited company can provide legal protection for your business name and brand, preventing others from using a similar name that could confuse customers.

Pvt Ltd Registration has also its multiple components which differs it on the basis of customers requirements. The specific types of company registration or classifications of private limited companies is following.

More DetailsThis is the most common type of private limited company. It is a separate legal entity with limited liability for its shareholders. The liability of each shareholder is limited to the amount unpaid on their shares.

In this type, there is no limit on the liability of the members. They are personally liable for the company's debts and liabilities. generally these kind of companies are rare in nature and very few person opt.

Members' liability is limited to the amount they agree to contribute to the company in the event of winding up. This structure is often used for some specific users who want to limit theirself by Guarantee.

This is a company with only one shareholder and one director. It allows a single individual to start a company and run a business with limited liability. This registration promotes Sole Properietorship concept.

A small company typically has lower regulatory requirements and benefits from certain exemptions, making it easier for small businesses to operate. MCA has defined Capital and turnover criterias for small companies.

This type of company is formed by individuals involved in activities related to primary production such as agriculture, dairy, etc. It has specific provisions to benefit its producer-members. Best for farmers, producers.

A company incorporated in a jurisdiction other than the one where it conducts its operations, often chosen for favourable tax and regulatory advantages. Most of big companies often register this company for tax saving.

A private limited company that is a subsidiary of a foreign parent company. In India you will see lots of companies whic are held by foreign companies such as coca cola, etc.

A holding company owns the majority of the shares of another company, known as its subsidiary. The subsidiary is effectively controlled by the holding company. these are normal companies of which shares held by another companies.

Customer satisfaction is our major goal. See what our clients are saying about our services.

Startup entrepreneurs can definitely prefer & rely on the services of Legal Pillars for Incorporation of LLP/Companies. Good service by Ms. Sneha Kapoor.

It is really one of the best team, which give lot of respect in dealings and help us at every moment. Thank you legal pillers for helping us at every small steps.

Good work, I am happy with services - Legal Pillers for providing best services for 12A80G in economical prices and in a good speed way. The co-ordination between various team members is also remarkable. Even they all continuously follow up with calls and messages regarding the processes. Also one more good point is all the services are under one umbrella. Special thanks to Shweta, Kalpana, Priya & all the backend team member for execution.

Team Legal Pillers, I am writing to thank you for the quality of service provided by your company. I am sincerely appreciating your efficient, gracious customer service on registering my company. Specially I would like to Thank Ritika who always connected with me and explained in detail while registering company. I would refer my friends to legal Pillers to take best service in low cost.

Very corporative and guides you in a proper way. This was my first time doing online legal services and out of all fear I had it turned out a boon for me. Hope you people keep the services same in future to. For a new startup u can believe them. Thank you once again

We are from Hyderabad, Telangana State. We have taken Services of "Legal Pillers" for New Private Ltd Company Registration. We are extremely satisfied and delighted with their services. They are sincere, experienced and committed. Unquestionable Integrity. Our Interaction was with Ms.Sneha, Mr.Rohit and Ms.Jyostna, excellent team and keeps their word.

Find answers to most popular questions asked to us.

A private limited company is a business entity that a small group of individuals or corporate entities privately holds. It is a separate legal entity from its owners and offers limited liability protection to its shareholders.

The time frame can be different according to your location. It may take a few weeks to a few months to complete the registration.

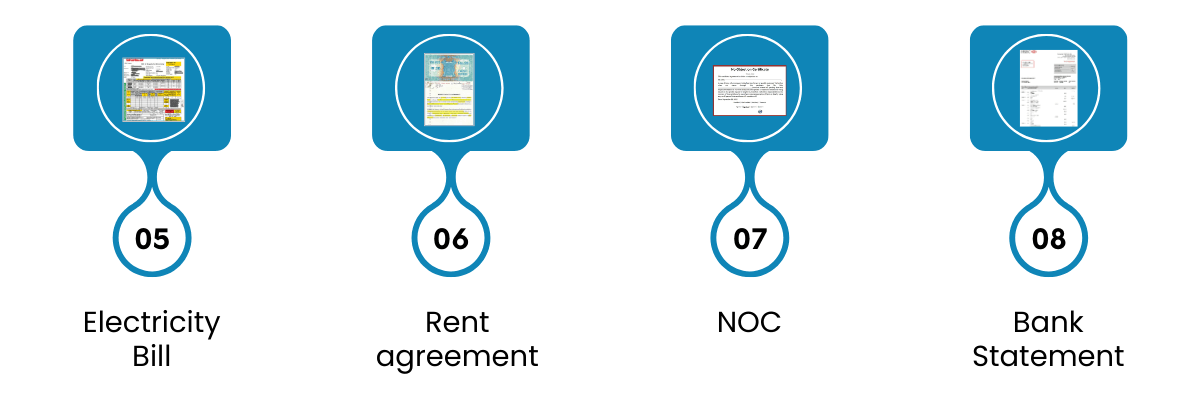

The requirements for the constitution of a private limited corporation include:

Members has to be in the range of 2-200.

At least two directors and two shareholders.

Each director should have an directors Identification (DIN) number.

PAN card copy of directors/shareholders and Passport copy for NRI subscribers.

Yes. The business must submit the proof of address for incorporation. However, there is a provision in the Ministry of Corporate Affairs (MCA) allows residential addresses to serve as the registered address of the company. This means that any address can be registered as an address.

Memorandum of Association (MOA) is defined in Section 2(56) of the Companies Act 2013. It is the basis upon which the firm is constructed. It is the basis for defining the company's constitution, powers and goals of the business. The Articles of Association (AOA) is defined in the section 2(5) of the Companies Act. It outlines all regulations and rules governing the management of the business.

Although SPICe is an electronic form however, SPICe+ is a fully integrated Web form that provides 10 services offered by 3 Central Govt. Ministries and Departments. (Ministry of Corporate Affairs Ministry of Labour & Department of Revenue within the Ministry of Finance) and One State Government (Maharashtra) which will save as many processes, time and costs to start an Business with a business in India. SPICe+ is part of several initiatives and the commitment to government officials of the Government of India towards Ease of Doing Business (EODB). SPICe INC 32 was being completed for incorporation of companies before February 15 2020. For incorporation of all new businesses, the SPICe+ form must be submitted on MCA portal.

In the event of incorporation of the company, up to three directors can fill out the integrated form to file a request for the allocation of DIN.

No, The Companies (Incorporation) Third Amendment Rules that were adopted on July 27, 2016 has relaxed the obligatory submission of evidence of identity and residency for subscribers with an authentic DIN.

It is a must to submit e-MOA and e-AOA in the following situations:

Individual subscribers are Indian citizens

If the who subscribe to the service are not foreign citizens who possess a valid DIN and DSC and must also provide evidence of the validity of their business visa

Non-individual subscribers with their base in India

?

After the acceptance of SPICe forms on acceptance of the forms, the Certificate of Incorporation (COI) will be issued along with valid PAN and TTAN as allocated by the department of Income Tax. A letter with an attachment of the COI with an attached documents and PAN as well as TAN can be sent to a person who applied. PAN and TAN included in the email will remain in force as the requirement to have laminated cards for PAN has been dispensed in.

The minimum share capital requirement varies by country. In some countries, there may not be a specific minimum requirement, while others may have a nominal amount.

In many countries, appointing a company secretary for a private limited company is legally required. The secretary is responsible for maintaining company records and ensuring compliance with regulatory requirements.

Private limited companies typically have ongoing compliance requirements, including filing annual financial statements, holding annual general meetings, and paying taxes.

Yes, changing the company name after registration is possible, but the process and requirements for name change can vary by jurisdiction.

Before proceeding for Private Limited Registration you must consider the factors which are important for its name selection. As per companies Act, 2013 the name must be unique and should not be similar or identical with existing company name. Following points need to consider before selecting name to register a company in India

Here is a list of some of the Compliances that we are providing after the Pvt ltd firm registration/ Private Limited Registration.

| Features | Pvt Ltd | LLP | OPC | Proprietorship |

|---|---|---|---|---|

| Meaning | Private Limited is a company which consider as a normal registration with 2 directors under Companies Act, 2013. | LLP is a newly introduced concept and is a mixture of Pvt Ltd and partnership firm register under LLP Act | OPC is also a type of Pvt Ltd having only one director and shareholder newly introduced by government | Any registration which govern sole ownership business format consider as sole firm registration such as GST, MSME, Shop Act Reg., etc |

| No of Person | Minimum 2 person required | min 2 person required | only one person required | only one person required |

| Liability | no liability on members | no liability on partners | no liability on member | personal liability of individual |

| Minimum Capital | Not required | Not required | Not required | Not required |

| Compliance | Applicable as per Companies Act 2013 | Applicable as per LLP Act | Applicable as per Companies Act 2013 | Not Mandatory |