Adi Swarup Patnaik

Startup entrepreneurs can definitely prefer & rely on the services of Legal Pillars for Incorporation of LLP/Companies. Good service by Ms. Sneha Kapoor.

Ready to get your NBFC License by Reserve Bank of India?

Customers Served

Project Delivered

Google Rating

10.5k+ Happy Reviews

Before applying for NBFC Registration with RBI, it is mandatory to fulfill the below conditions:

Note: Above charges are excluding gov. fees & other charges.

Note: Above charges are excluding gov. fees & other charges.

Note: Above charges are excluding gov. fees & other charges.

Connect with our Experts and Get personalized Solution.

Book your Call Now

Are you planning to create a Non-Banking Financial Company (NBFC) in India? The procedure for NBFC Registration can be complicated, with many legal and regulatory requirements. Don't worry! Legal Piller's expert panel of CA/CS, Advocates, and Tax Consultants specializes in offering NBFC registration services that help you navigate the registration process. Our team has been employed in several large NBFCs and is well-versed in RBI master directions applicable to NBFCs. If you are engaged in the business of providing loans & advances, acquisition of shares/stocks/bonds/debentures/securities or other marketable securities of similar nature, leasing, hire-purchase, insurance business, Digital lending or co-lending and any additional financing or investment then as per RBI guidelines on Principal business criteria (PBC), you will require to apply for NBFC certificate of registration with RBI. The Reserve Bank of India strictly controls and ensures that NBFCs adhere to the regulations and provisions set forth by Chapter III B in the RBI Act, 1934.

More DetailsIts registration is done with the Reserve Bank of India(RBI) which makes it a better registration option than others.

Non Banking Financing companies are directly government by RBI. however, these are registered under Companies Act, 2013 and have to follow compliances of said act along with RBI guidlines.

To register a NBFC Company in India you don't need to be physically present at any offices. It's a 100% Online process. Our professionals will complete liasioning work with RBI on your behalf.

NBFCs offer customized loan solutions and initiate faster loan processes. You can easily start your fintech company.

NBFC is highest form of registration for Lending and other non banking business regulated by Reserve Bank of India directly.

NBFCs have flexibility to design and offer a diverse range of financial products and services according to the specific needs of customers.

Diversification of risks across a variety of assets, sectors, or products is a characteristic of NBFCs, helps in manage risks effectively.

Your NBFC can provide financial services where traditional banks may not venture, fostering economic inclusion and growth.

NBFCs play an important role in providing financial assistance to small and medium-sized enterprises.

NBFCs often adopt cutting-edge technologies to streamline operations and enhance customer experiences.

NBFCs are classified into two types, On The Basis Of Liabilities & NBFCs based on their Activities: At present, RBI is not allowing any new licenses in Deposit-taking NBFCs under Liabilities category. Some major types of NBFCs are:

More DetailsPrimarily engaged in the financing of physical assets like automobiles, construction equipment, industrial machines, etc

Engaged in the acquisition of securities, such as shares, stocks, bonds, debentures, or other marketable securities.

Primarily engaged in providing loans and advances, whether secured or unsecured, against securities, property, or assets.

Provides finance to infrastructure projects and has a minimum of 75% of its total assets in infrastructural loans.

A Non-Deposit NBFC (ND-NBFC) holds at least 90% of its total assets in the form of investment in equity shares, debentures, or debt in group companies.

Engaged in providing financial services like micro-credit, micro-insurance, and micro-savings to low-income individuals and groups.

Engaged primarily in the business of providing finance for housing or real estate development.

Engaged in the business of factoring, which involves buying receivables and financing against them.

Customer satisfaction is our major goal. See what our clients are saying about our services.

Startup entrepreneurs can definitely prefer & rely on the services of Legal Pillars for Incorporation of LLP/Companies. Good service by Ms. Sneha Kapoor.

It is really one of the best team, which give lot of respect in dealings and help us at every moment. Thank you legal pillers for helping us at every small steps.

Good work, I am happy with services - Legal Pillers for providing best services for 12A80G in economical prices and in a good speed way. The co-ordination between various team members is also remarkable. Even they all continuously follow up with calls and messages regarding the processes. Also one more good point is all the services are under one umbrella. Special thanks to Shweta, Kalpana, Priya & all the backend team member for execution.

Team Legal Pillers, I am writing to thank you for the quality of service provided by your company. I am sincerely appreciating your efficient, gracious customer service on registering my company. Specially I would like to Thank Ritika who always connected with me and explained in detail while registering company. I would refer my friends to legal Pillers to take best service in low cost.

Very corporative and guides you in a proper way. This was my first time doing online legal services and out of all fear I had it turned out a boon for me. Hope you people keep the services same in future to. For a new startup u can believe them. Thank you once again

We are from Hyderabad, Telangana State. We have taken Services of "Legal Pillers" for New Private Ltd Company Registration. We are extremely satisfied and delighted with their services. They are sincere, experienced and committed. Unquestionable Integrity. Our Interaction was with Ms.Sneha, Mr.Rohit and Ms.Jyostna, excellent team and keeps their word.

Find answers to most popular questions asked to us.

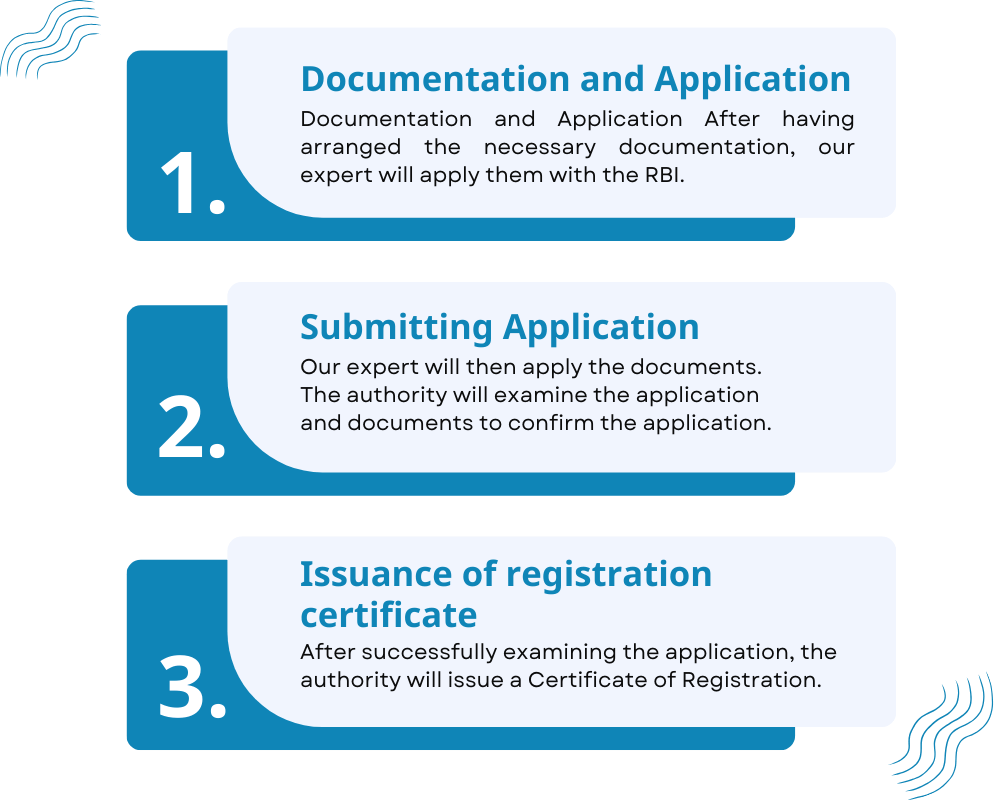

Acquiring an NBFC license involves a structured process mandated by the Reserve Bank of India (RBI). At Legal Pillers, we specialize in guiding businesses through every step of this process.

A Non-Banking Financial Company (NBFC) is a financial institution that provides banking services without meeting the legal definition of a bank.

Initiating an NBFC in India requires meticulous planning, thorough documentation, and compliance with the RBI guidelines. Our team at Legal Pillers is well-versed in the process and can assist you in every aspect.

Yes, registration with the Reserve Bank of India (RBI) is mandatory for any entity wishing to operate as an NBFC in India.

An NBFC Bank, also known as a Non-Banking Financial Company that functions as a Bank, offers services similar to traditional banks, such as lending and investing.

Unlike banks, NBFCs cannot issue checks drawn on themselves, and they do not form part of the payment and settlement system. They are not allowed to accept demand deposits.

In the event of incorporation of the company, up to three directors can fill out the integrated form to file a request for the allocation of DIN.

There are different categories of NBFCs based on their activities, such as Asset Finance Companies, Loan Companies, Investment Companies, Infrastructure Finance Companies, Infrastructure Debt Funds, Microfinance Institutions, and more.

NBFCs in India are primarily regulated by the Reserve Bank of India (RBI) under the regulations of the Reserve Bank of India Act, 1934.

The minimum capital requirement for an NBFC in India varies depending on the type of NBFC. Our well versed expert guides you through the entire process of the registration.

Some NBFCs are allowed to accept public deposits, while others are not. Those permitted to take deposits are regulated more strictly and need to follow specific rules and regulations set by the RBI.

NBFCs provide a wide range of financial services, including lending, leasing, hire-purchase, insurance, investment in stocks and bonds, and more. They often serve specific niches or industries.

yes, there are some Compliance Requirements for NBFC. Our team is well-versed in the regulations and will guide you in meeting all compliance with Anti-Money Laundering (AML) and Know Your Customer (KYC)guidelines.